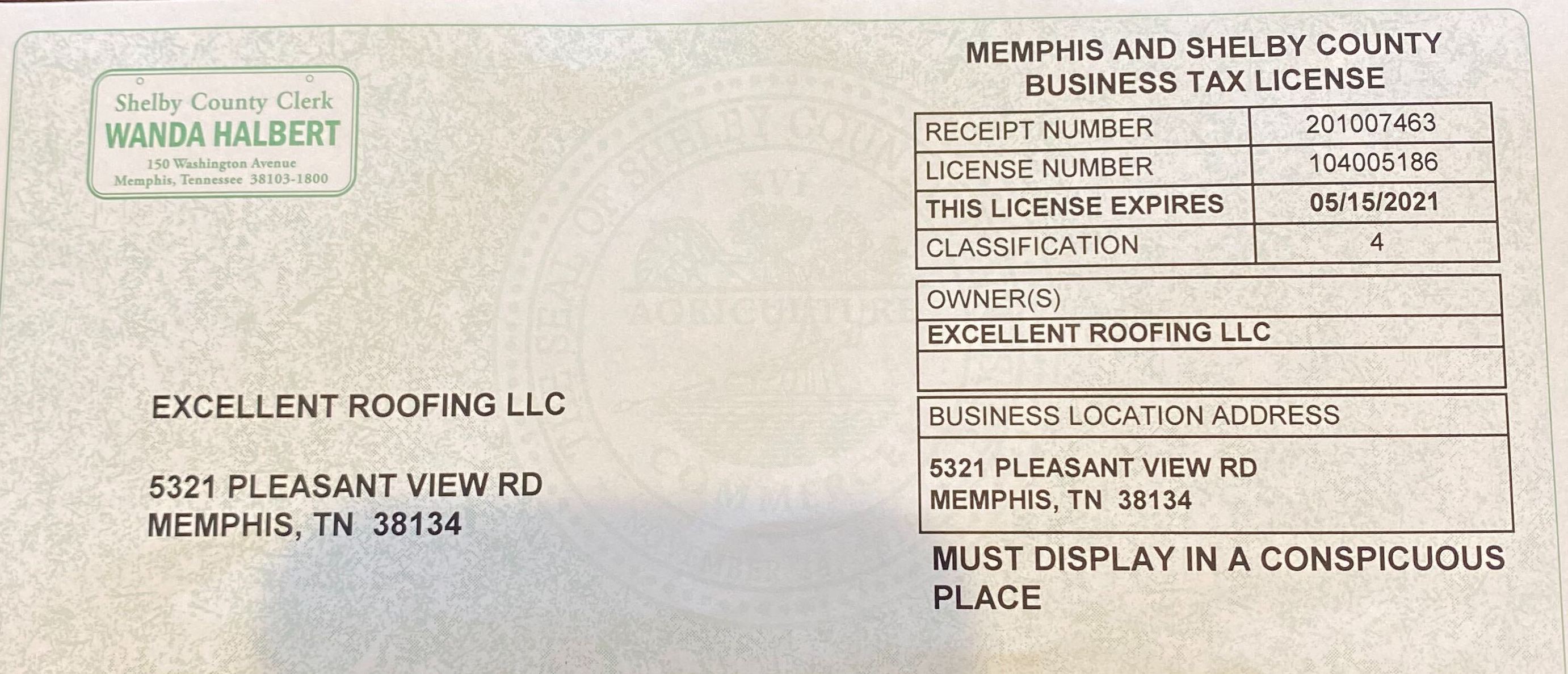

Business License Memphis Tn

About Business Licenses in Tennessee The Tennessee Secretary of State Division of Business Services is responsible for business and corporate records.

Business license memphis tn. This License number must be recorded by the Purchasing Service Center before the issuance of any purchase order or contract. For those closest to the downtown area the address is 150 Washington Avenue Second Floor Memphis TN 38103. Corporations limited liability companies limited liability partnerships and other business entities file documents through the Secretary of State.

The state administered business tax is a tax based upon business gross receipts which is due annually. A remittance of 15 must be submitted with each application. Tennessee is a great place to start a new business.

The business license application link is found on the bottom of the page. MEMPHIS SHELBY COUNTY BUSINESS LICENSE. A separate 15 business license registration fee must be paid to the county andor municipal clerk for each new business.

You must also report your gross receipts for the reporting period and pay the business tax due on the return. Useful information about starting maintaining and doing business in the State of Tennessee. If your business is within the municipal boundaries of Memphis you must purchase a combined City of Memphis and Shelby County Business License.

The renewal process is simple. If your business requires registration for one of the tax types below please visit the Taxes section of our website for instructions on how to complete the paper application for registration. Where to search for Business Licenses online.

Learn about Business Licenses including. Television and Telecommunications Sales Tax. If the business is operating within a municipality a separate city business license is required.