Typical Business Loan Interest Rate

The average business loan interest rate in 2020 can vary by loan type so its important to know what options are available and how much theyll cost you.

Typical business loan interest rate. Particularly with small business loans interest rates should be reasonable to help the. The 7a loan program is the Small Business Administrations most. If you borrowed 10000 with a 5-year term and an interest rate of 3 compounded annually your interest payable over the entire course of the loan is 159274.

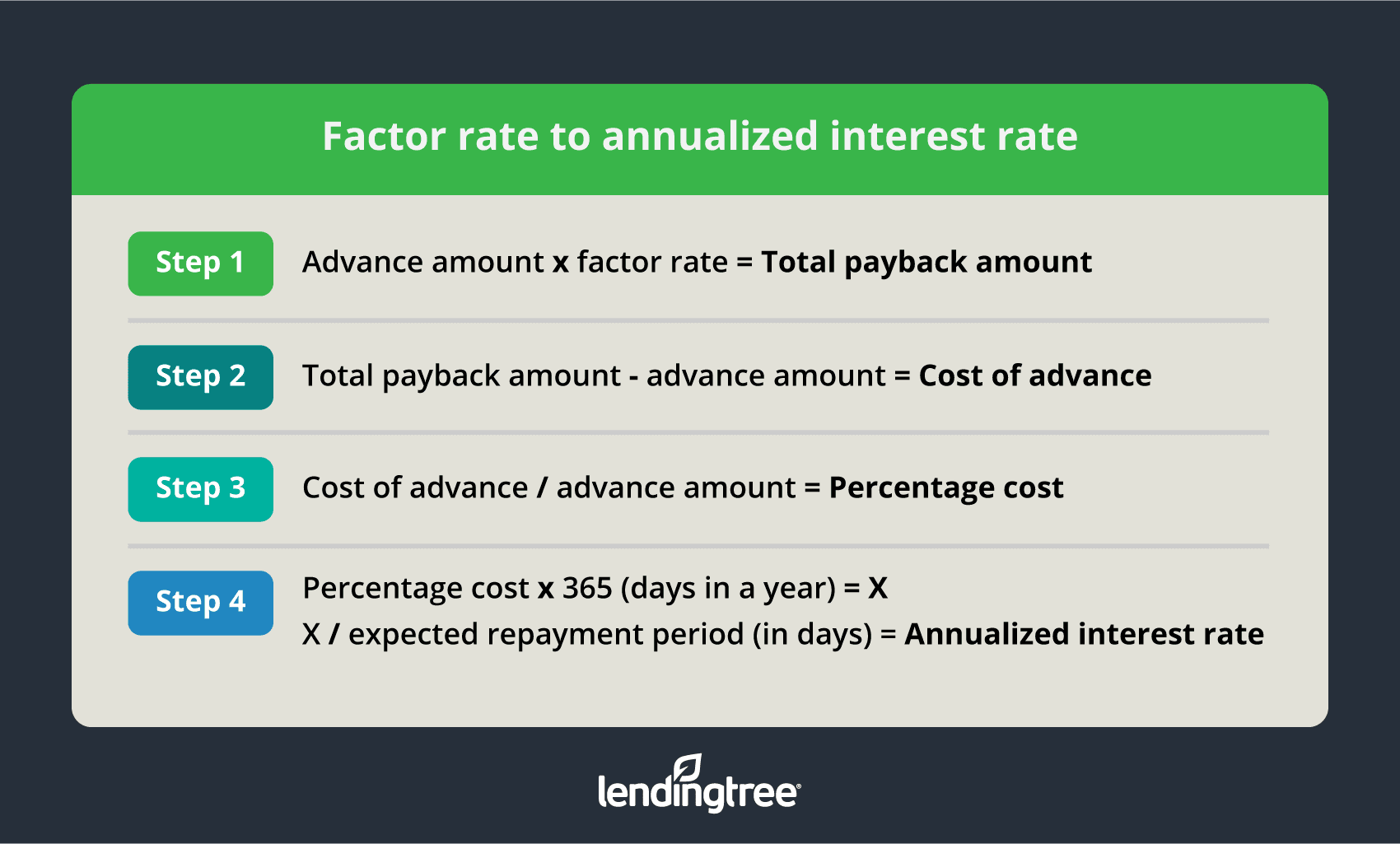

Heres what you need to know about what interest rates to expect how interest rates are determined and how a loans annual percentage rate affects your business. How typical business loan interest rates work. Interest rates for business lines of credit might run anywhere from 5 to more than 20.

10000 x 1 3 5 10000 159274 Annual percentage rate APR. Here are typical ranges for the most common types of small-business loans using data pulled directly from lenders in a 2019 report from ValuePenguin a division of LendingTree. The average 30-year fixed mortgage rate fell 7 basis points to 293 from a week ago.

We found that interest rates for small business loans from banks generally range between 6 and 13 percent depending on the size of the loan and the risk factor of your business. Additional mortgage rates can be. Average Small-Business Loan Interest Rates.

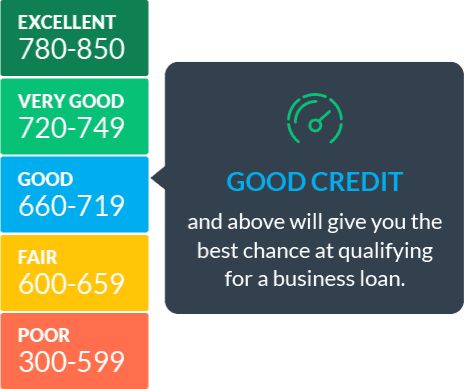

With so many different types of business loans available for borrowers across a broad credit spectrum the answer isnt entirely clear. Advertised rates are always low but your business characteristicsas well as the type of lender you usedetermine how much youll really pay. Funding Circle are committed to making business loans quick and simple so you can take advantage of their streamlined application process.

Interest rates for business loans are calculated based on risk. The average interest rate for a small business loan varies depending on your. The 15-year fixed mortgage rate fell 3 basis points to 237 from a week ago.