What Does Overhead Mean In Business

Overhead costs are company expenses that tend to happen regardless of production and sales levels.

What does overhead mean in business. These ongoing expenses support your business but are not linked to the creation of a product or service. Overhead includes activities that are not directly related to the products or services that the firm offers but they support the firms profit-making activities. Overhead expenses vary depending on the nature of the business and the industry it operates in.

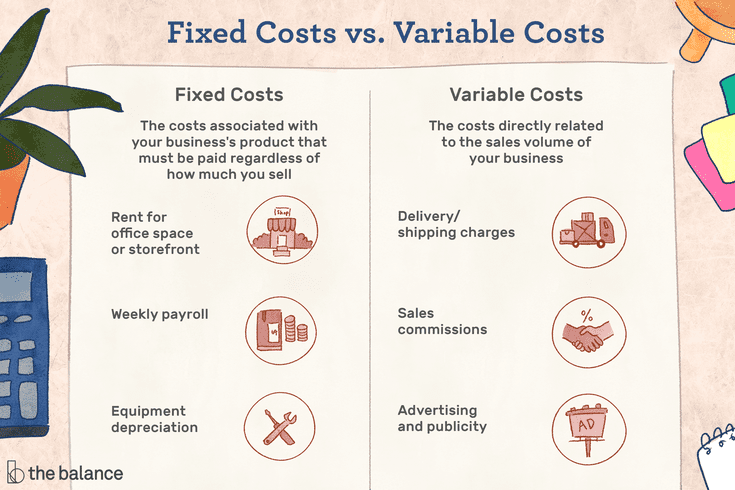

We also call it the operating expense It is an expense that the owner must pay even when the business does not earn any revenue. Therefore overhead costs are different to direct costs. Overhead costs are all of the costs on the companys income statement except for those that are directly related to manufacturing or selling a product or providing a service.

Whats the definition of overhead anyway. Overhead costs often referred to as overhead or operating expenses refer to those expenses associated with running a business that cant be linked to creating or producing a product or service. Overhead refers to the ongoing costs to operate a business but excludes the direct costs associated with creating a product or service.

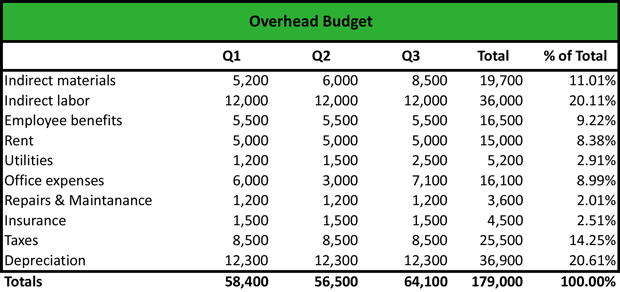

Operating expenses are the result of a businesss normal operations such as materials labor and machinery involved in production. Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit. Overhead costs are a key component for making up the total cost to run a business and are made up of ongoing costs that must be paid regardless of the companys current volume of business.

The indirect costs or fixed expenses of operating a business that is the costs not directly related to the manufacture of a product or delivery of a service that range from. Without these expenditures a company would not be able to function but they do not contribute directly to the generation of profits. In business overhead or overhead expense refers to an ongoing expense of operating a business.

When corporate costs are incurred they are considered to be period costs and so are charged to expense as incurred. Overhead is still necessary since it provides critical support for the generation of profit-making activities. For example if your business makes widgets the cost of metal is a raw material and is not considered overhead.