Us Small Business Administration Disaster Business Loan Application

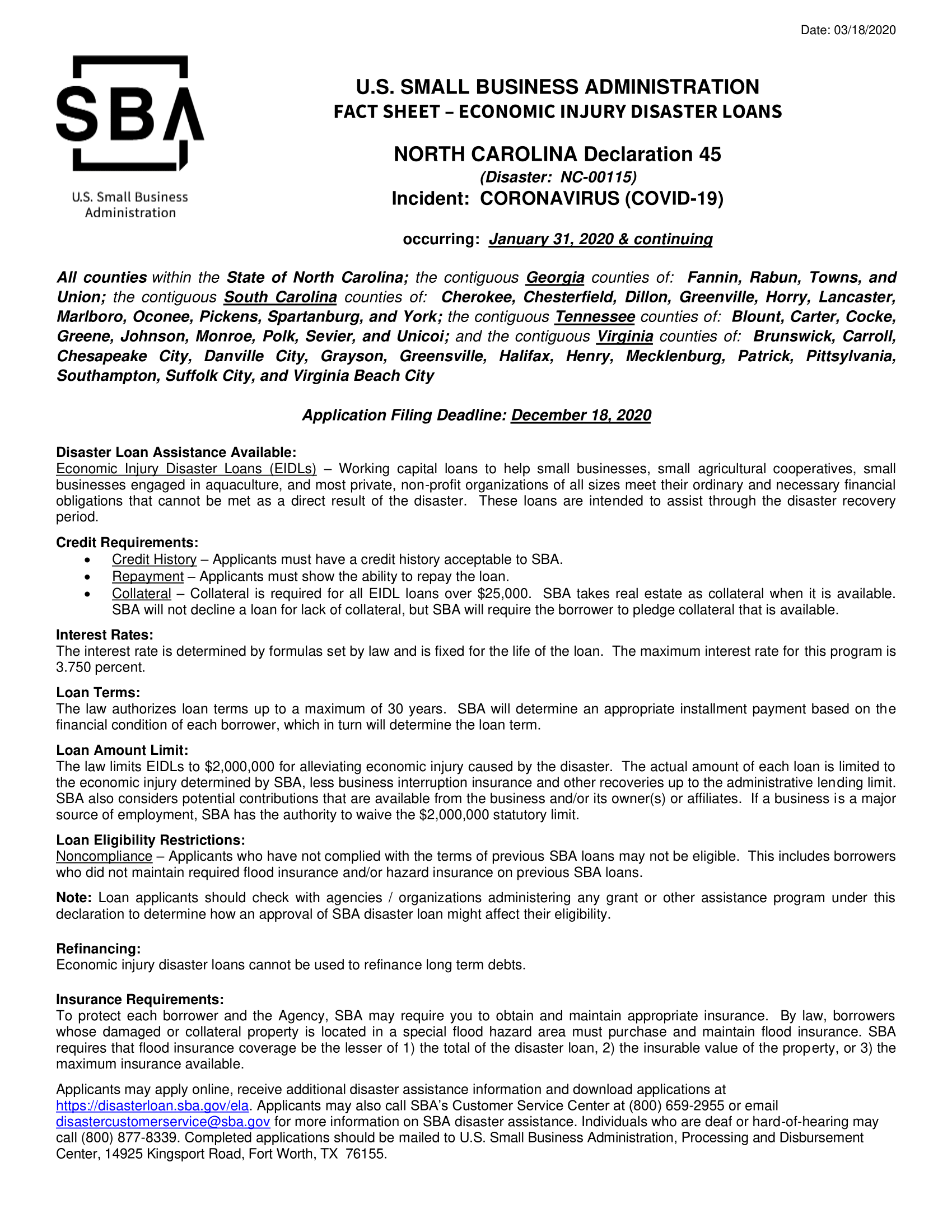

The information will be used in determining whether the applicant is eligible for an economic injury loan.

Us small business administration disaster business loan application. The SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. The online application is the fastest method to receive a decision about your loan eligibility. Disaster Business Loan Application.

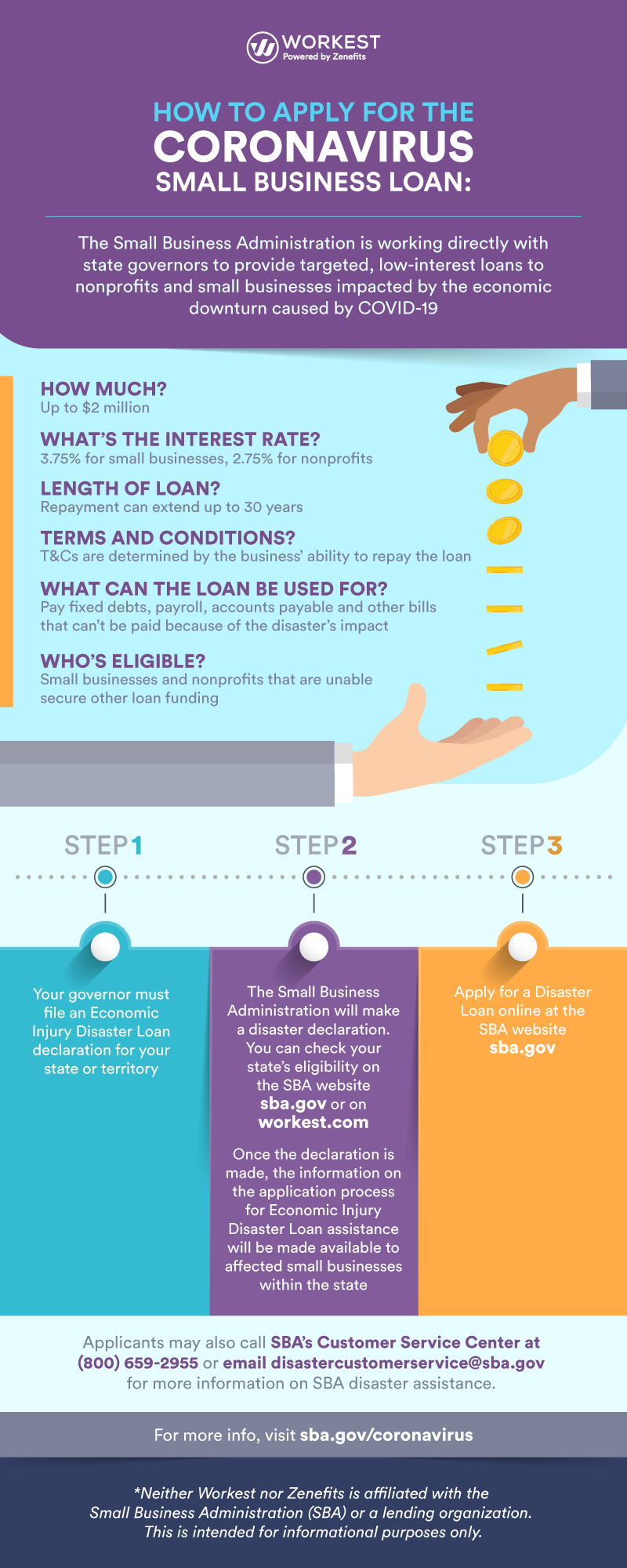

An eligible small business or nonprofit must not have received a US. Economic Injury Disaster Loans of up to 2million are available. If you are in a declared disaster area and have suffered any disaster related damage you may be eligible for federal disaster assistance.

SBA is collecting the requested information in order to make a loan under SBAs Economic Injury Disaster Loan Program to the qualified entities listed in this application that are impacted by the Coronavirus COVID-19. On June 15 SBA resumed accepting new Economic Injury Disaster Loan EIDL applications from all eligible small businesses private non-profits and US. You can apply online for all types of SBA disaster assistance loans.

SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster. Apply online at httpsdisasterloansbagovela OR send completed applications to. SBA loans are long-term small business loans partially guaranteed by the government.

Now Accepting New Applications for Economic Injury Disaster Loans. The SBA also asks for permission to contact the loan preparer. SBA is the primary source of Federal money for long-term disaster recovery.

Small Business Administration Processing and Disbursement Center 14925 Kingsport Road Fort Worth Texas 76155. The woman said she doesnt own a business and wants to clear her identity. You dont have to own a business.