Small Business Valuation Formula Multiples

The Capitalization of earnings method is very common in valuing small business and real estate investments.

Small business valuation formula multiples. They are a quick way to arrive at a general estimate of the businesss sale price. 355598 161598 Estimated Business Value 234000 Estimated Real Estate Value 40000 Liabilities Our business valuation expert helped us put together these values. The business value is calculated by simply dividing the business earnings by the so-called capitalization rate.

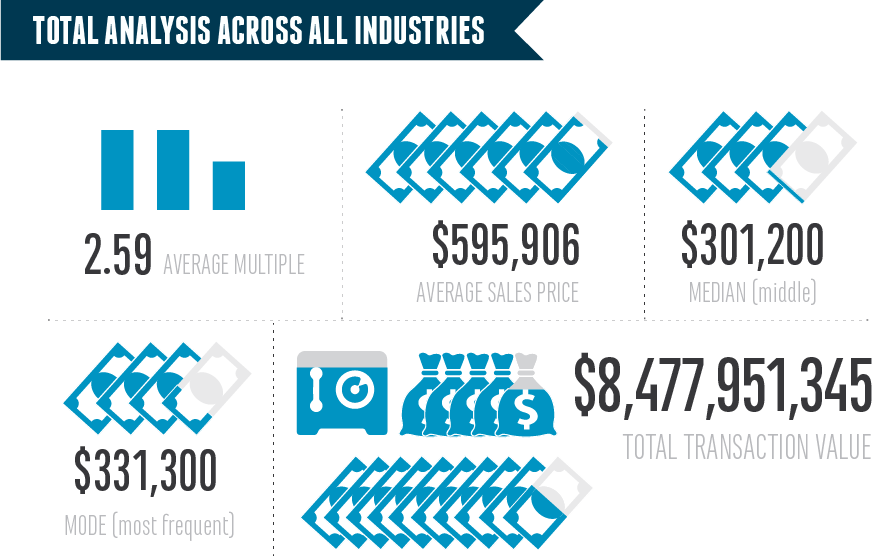

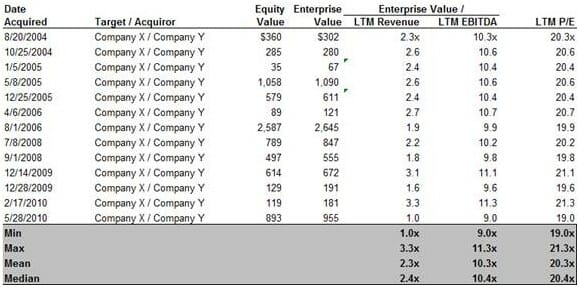

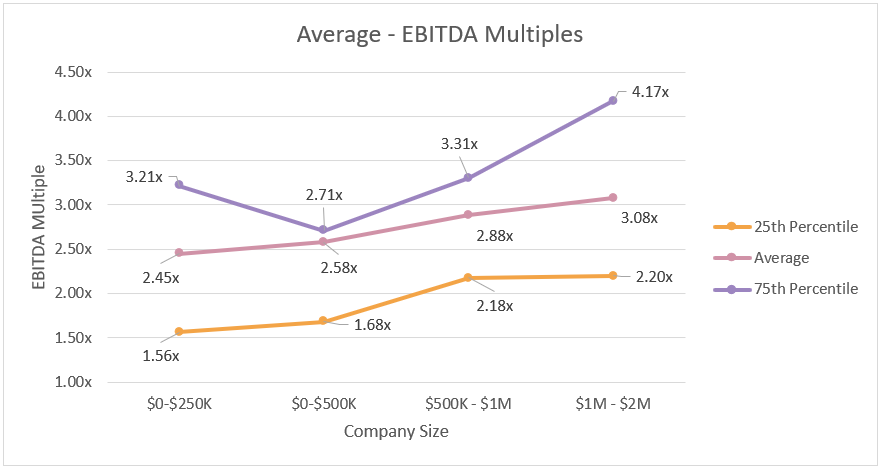

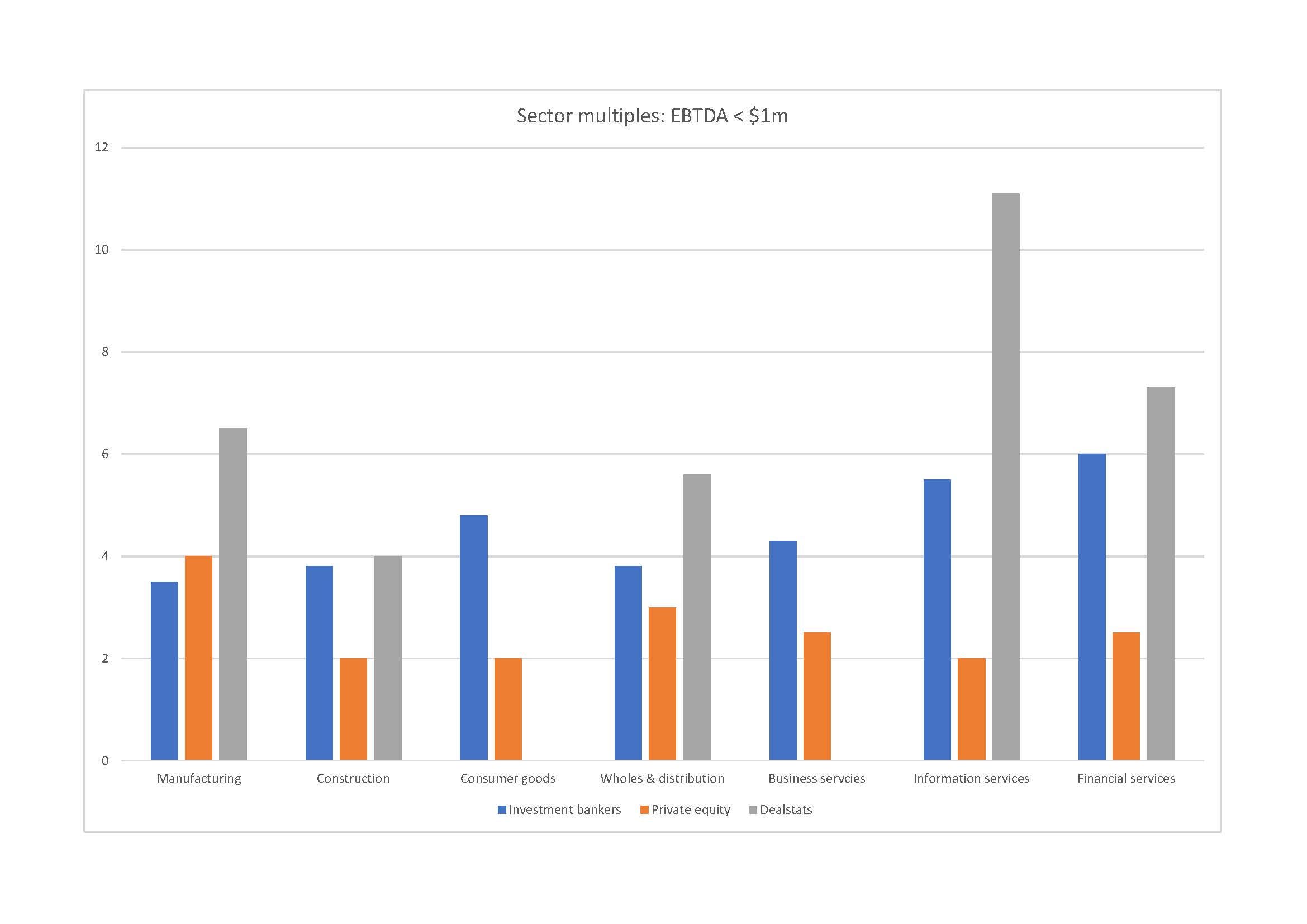

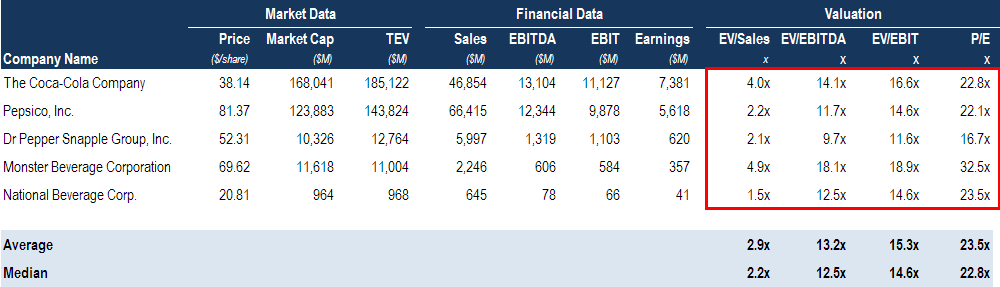

Business Valuation Resources recently published EBITDA multiples by industry in our DealStats Value Index DVI. If the earnings of the business are 900000 the multiples of earnings calculation mean the business may be valued for sale at 1800000. While valuation guidelines and example selling multiples by industry and many times more accurate than generic overall rules of thumb its important to understand that every business is different and thus your valuation may differ.

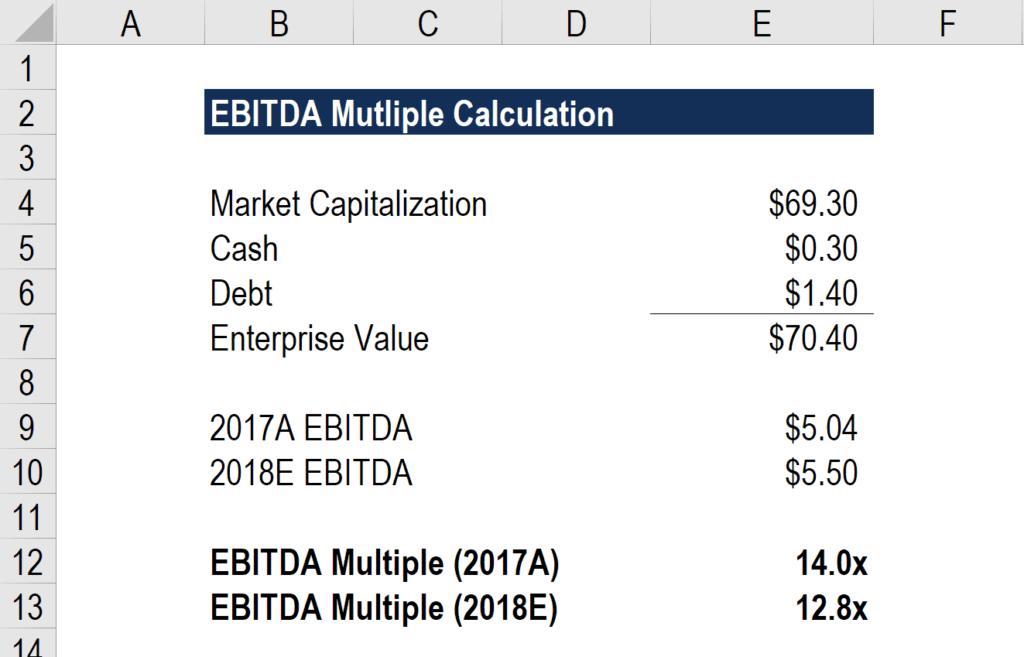

Rate of 20 percent the value of your excess earnings is 626000. We hope this guide to EVEBITDA multiples has been helpful. A business valuation expert can help sellers obtain the best price for their business while also ensuring that the sales price is based on strong data.

Data includes enterprise value multiples for 2018 2019 and 2020. Although Joes Restaurant has had reasonable success in the past the industry is trending away from independently owned restaurants. Add to this the current market value of your assets and you arrive at a total price of 906000 for the business 626000 280000 906000.

Free Valuation Multiples Registered Users Valuation Multiples by Industry Background to Valuation Multiples Glossary User Guide. Although I emphasize that every business situation is different and that exogenous factors such as what is going on the stock market and the outlook for the economy as a whole can have an impact I am going to stick my neck out and offer some simple business valuation guidelines. The value of the business has now decreased by 40 with a single adjustment.

The multiple is similar to using a discounted cash flow or capitalization rate used by top business valuation appraisers and top analysts. Appraisal method for small businesses sales less than 2 - 3 million Price Earnings multiple Apply a multiple to the earnings Earnings SDE 250000 Price Earnings Multiple 4 Value 1000000. Shows the present value of a businesss future cash flow discounted according to the risk involved in purchasing the business.