Small Business Health Insurance Ohio

The Small Business Relief Grant is designed to provide relief to Ohio businesses that have been negatively affected by COVID-19.

Small business health insurance ohio. Get a customized quote for your small business in just minutes. Health Insurance for Small Businesses Providing healthcare benefits is a smart way to attract and retain loyal employees. Looking to purchase group health insurance in Ohio.

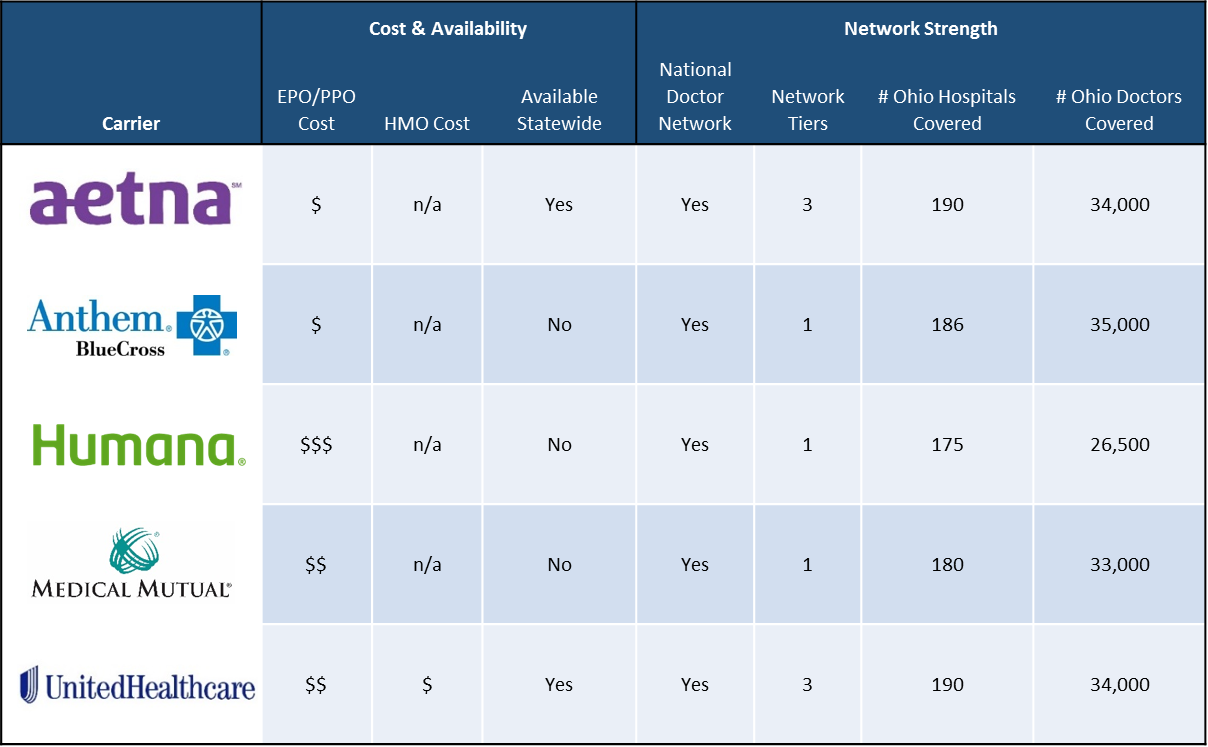

Your employees are your greatest investment. Small Business Health Insurance in Ohio UnitedHealthcare. Learn more about MEWA health insurance options.

Anthem has a variety of flexible spending and health account options in Ohio to fit your small or large business needs. Governor Mike DeWine has designated up to 125 million of funding received by the State of Ohio from the federal CARES Act to provide 10000 grants to small businesses to help them through the current crisis. Small Business Relief Grants Ohio recently designated 125 million of federal CARES Act funding to aid families businesses and others who have been impacted by COVID-19.

COSE is pleased to offer a new self-insured benefit option. With UnitedHealthcare your employees will have access to quality cost-effective health care. Under the Affordable Care Act employers with under 50 full time employees in Ohio use community based rates to offer health insurance policies within a given territory at the same price to all persons without medical underwriting regardless of their health status.

UnitedHealthcare can help you understand your small business health insurance options. Small Business Relief Grant. Get a customized quote for your small business in just minutes.

In order to qualify for a group health insurance plan you must. UnitedHealthcare can help you understand your small business health insurance options. Explore group health plans from UnitedHealthcare in Ohio.