Qualified Business Loss Carryforward

What if there is no qualified business income or loss.

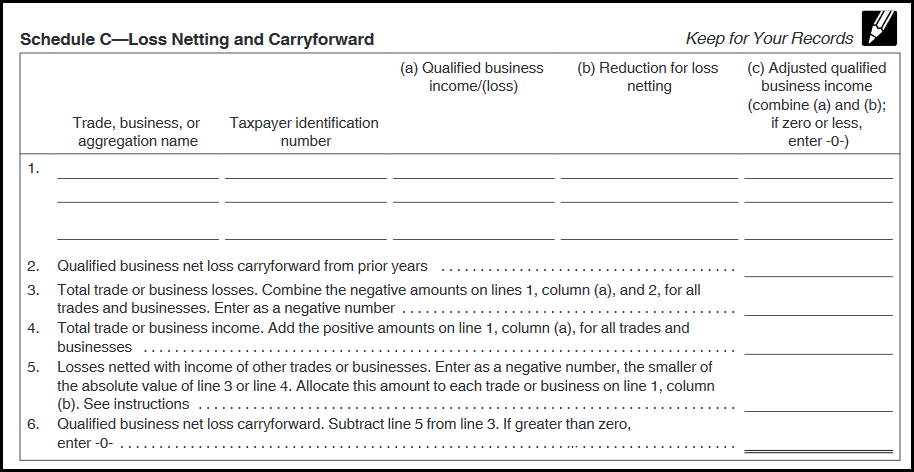

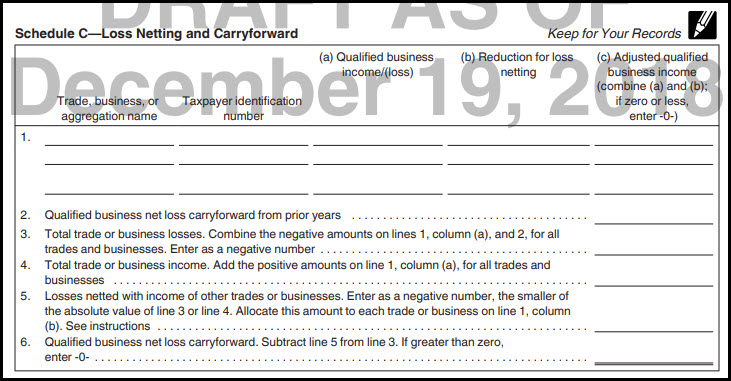

Qualified business loss carryforward. 2 3 Qualified business net loss carryforward from the prior year 3 4 Total. See Determining Your Qualified Business Income earlier and Tracking Losses or Deductions Suspended by Other Provisions later. The loss is then subtracted from the income to determine the adjusted qualified business income column C and those are the amounts that carry to Form 8995-A Part II line 2.

Include prior year qualified loss carryforwards even if the loss was unreported or the trade or business that generated the loss is no longer in existence. So if you have a loss in one business and income for another your loss will reduce the income. If the net overall QBI is less than zero it is carried forward as a loss from a separate qualified business and will reduce any potential QBI deduction in the following year IRC Sec.

Pages 37 This preview shows page 18 - 22 out of 37 pages. But more specifically it is the net amount of income gain deduction and loss from your business. This information will be reported on a Schedule K-1 or a.

You deduct such a loss on Form 1040 against any other income you have such as salary or investment income. Depending on the form being produced this amount will carry to Form 8995 Line 3 or to Form 8995-A Line 2 allocated proportionately across all the businesses. A tax loss carryforward allows taxpayers to use a taxable loss in the current period and apply it to a future tax period.

172 b 1 D. 31 2017 the net operating loss carryover is limited to 80 of taxable income determined without regard to the deduction. Include here the qualified portion of trade or business loss carryforward allowed in calculating taxable income in the current year even if the loss was from a trade or business that is no longer in existence.

See the instructions for Form 6198 for more information or check with your CPA or tax advisor. Meaning do I carry the loss forward and apply it to the business in the future. If there is a business loss it is carried over to the next year.