Qualified Business Income Deduction 2019

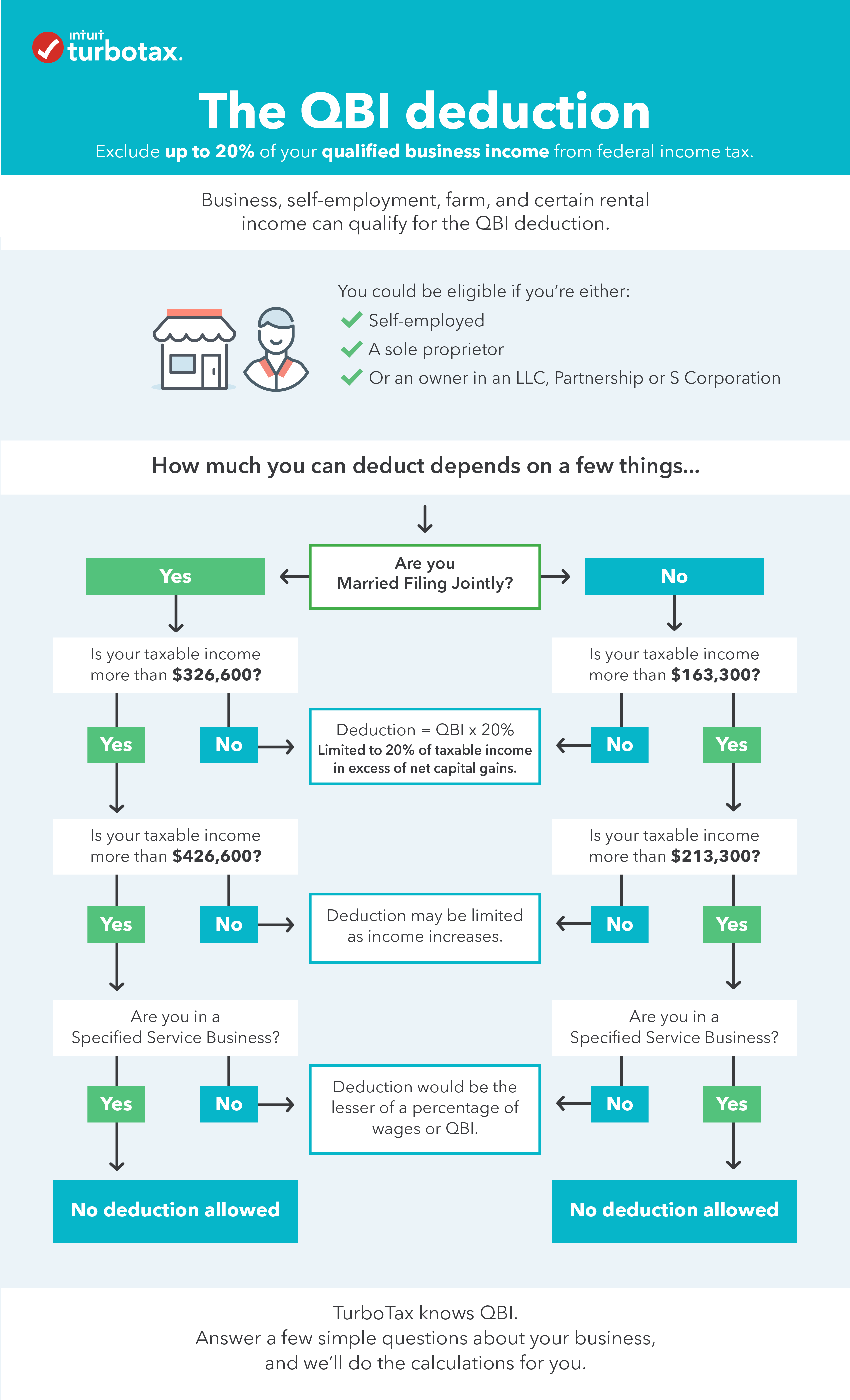

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income.

Qualified business income deduction 2019. Many individuals including owners of businesses operated through sole proprietorships partnerships S corporations trusts and estates may be eligible for a qualified business income deduction also called the section 199A deduction. But its also true that when claiming this pass-through deduction it cant add up to more than 20 of. Some trusts and estates may also claim the deduction directly.

Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net QBI from a trade or business including income from a pass-through entity but not from a C corporation plus 20 of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income. Generally taxpayers can deduct 20 of QBI qualified cooperative dividends qualified REIT dividends and qualified publicly traded partnership PTP income. Start by using your taxable income NOT your adjusted gross income AGI.

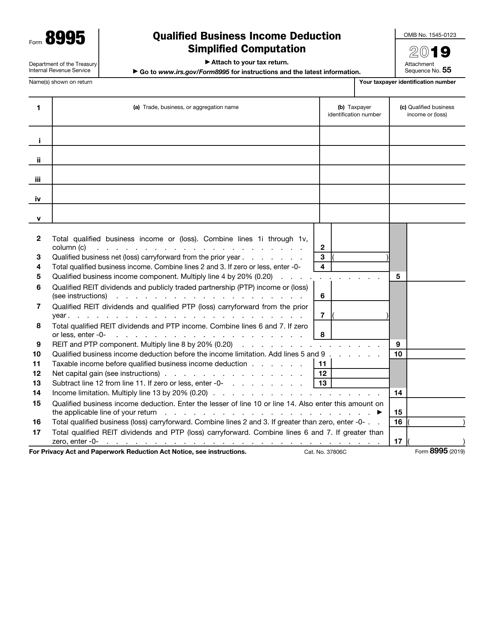

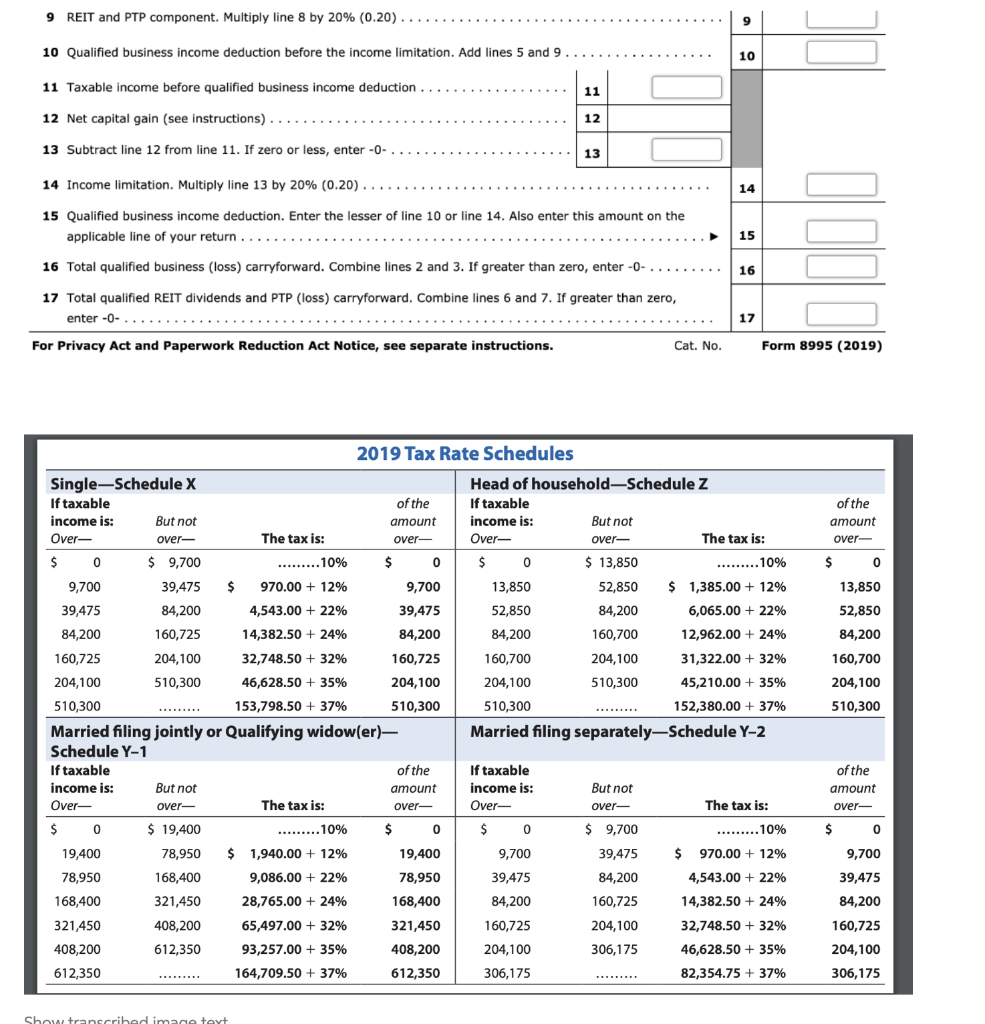

Qualified business income component. Enter the amount from line 10 Subtract line 18 from 17 Taxable income before QBI Deduction Threshold. Subtract 14 from 13 Total QBI component.

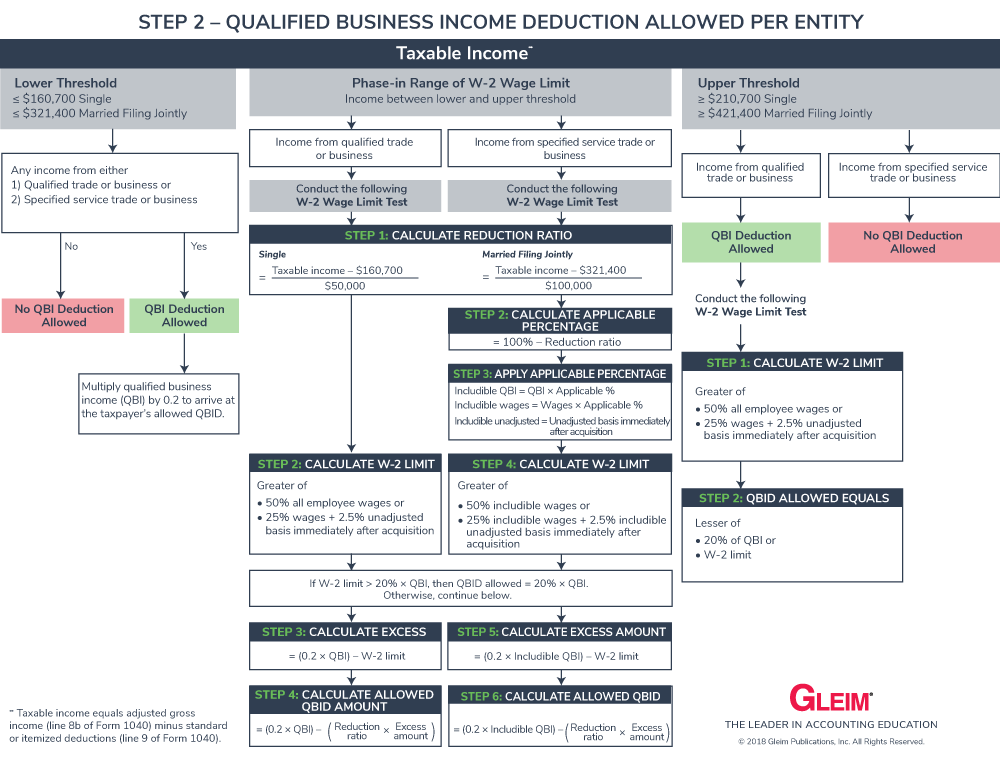

Does the deduction reduce earnings subject to self-employment tax. For tax year 2019 Form 8995 Qualified Business Income Deduction Simplified Computation and Form 8995-A Qualified Business Income Deduction will be available and will replace the worksheets found in the Form 1040 instructions and Publication 535 respectively. 163300 for all others your QBI for each of your trades or businesses may be partially or fully reduced to the greater of 50 of W-2 wages paid by the qualified trade or business or 25 of W-2 wages plus 25 of the UBIA of qualified property from the qualified trade or business.

If you have qualified business income from a qualified trade or business real estate investment trust dividends publicly traded partnership income or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. 199A The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to 160700 of qualified business income for unmarried taxpayers and 321400 for married taxpayers Table 7. Enter 157500 315000 if MFJ.

Generally the deduction is equal to the lesser of 20 percent of qualified business income or 20 percent of taxable income less net capital gain. The qualified business income deduction is worth up to 20 of your taxable business income. With the QBI deduction most self-employed taxpayers and small business owners can exclude up to 20 of their qualified business income from federal income tax but not self-employment tax whether they itemize or not.