Pwc Business Combinations Guide

We developed and designed our guide A guide to accounting for business combinations fourth edition to help assist middle market companies in accounting for business combinations under Topic 805 Business Combinations of the Financial Accounting Standards Boards FASB Accounting Standards Codification.

Pwc business combinations guide. 37 Full PDFs related to this paper. Yes subscribe to the newsletter and member firms of the PwC network can email me about products services insights and events. This guide summarizes the applicable accounting literature including relevant references to and excerpts from the FASBs Accounting Standards Codification t he Codification.

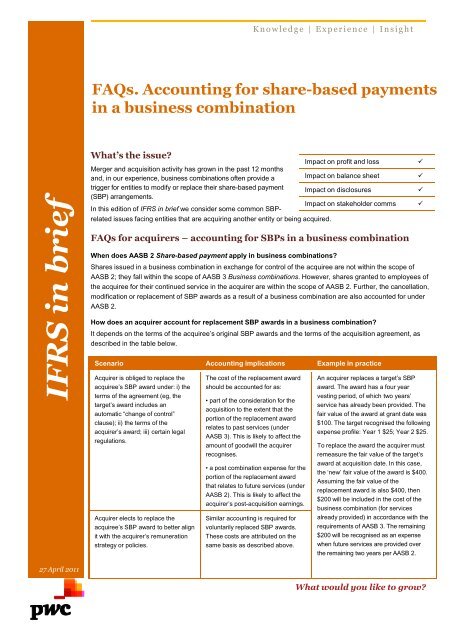

Business combination between the acquirer and acquire and states. Our FRD publication on business combinations has been updated to reflect recent standard-setting activity and to further clarify and enhance our interpretive guidance in several areas. Paragraph B52 of IFRS 3 provides guidance on how to account for a pre-existing relationship in a.

Recognises a gain or loss measured as follows. If the business combination in effect settles a pre-existing relationship the acquirer. A roadmap to accounting for business combinations.

Business Combinations Business Combinations SEC Reporting Considerations Carve-Out Transactions Comparing IFRS Standards and US. GAAP Consolidation Identifying a Controlling Financial Interest Contingencies Loss Recoveries and Guarantees Contracts on an Entitys Own Equity Convertible Debt Current Expected Credit Losses Debt. I whether I acquired a business or just an asset ii how do I recognise and measure the identifiable assets acquired liabilities assumed and possibly non-controlling interest in the acquiree iii how do I recognise and measure goodwill or perhaps even a bargain purchase gain iv which.

Pwc business combinations noncontrolling interests. PwC is pleased to offer this global accounting and financial reporting guide for Business combinations and noncontrolling interests. Generally accepted accounting principles and International.

Asset acquisitions November 23 2020. We explain the accounting for acquisitions of businesses and related issues with examples and analysis. Business combinations IFRS 3 Employee benefits IAS 19 Business combinations under common control and capital re-organisations.