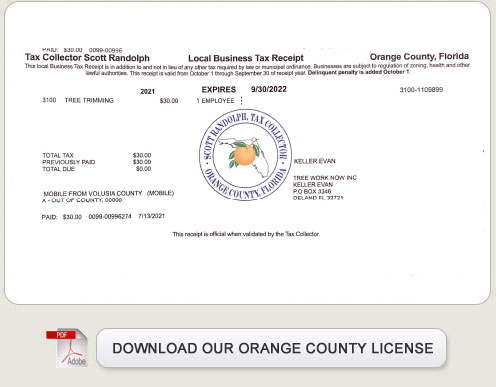

Orange County Business Tax Receipt

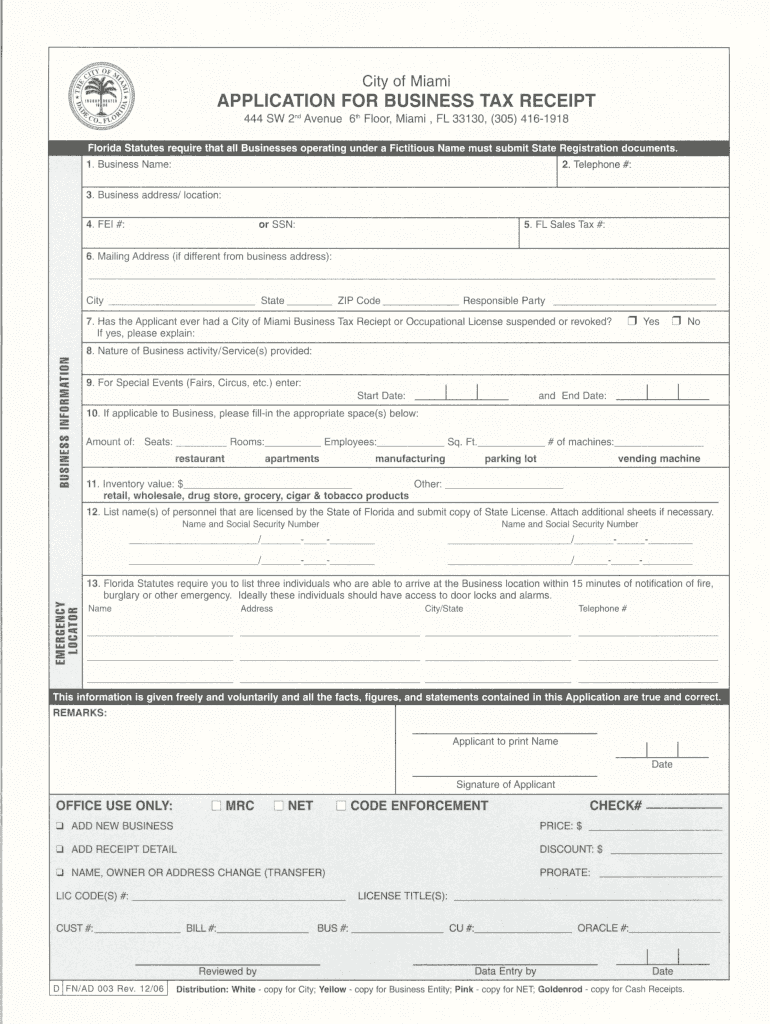

It must be completed and returned to the City no later than June 1st.

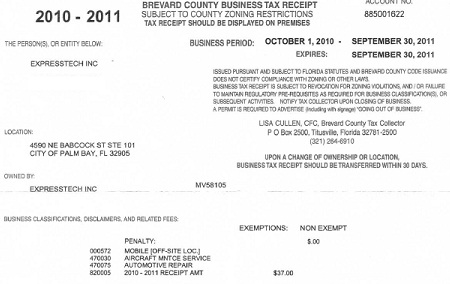

Orange county business tax receipt. Orange County Tax Collector PO. In addition to a City Business Tax Receipt businesses are also required to obtain a County Business Tax Receipt from Volusia County once the Citys is obtained. All businesses operating in these municipalities must obtain a Local Business Tax Receipt prior to obtaining an Orange County Business Tax Receipt.

However you may renew your Business Tax Receipt or drop your application off at any of our branch office locations. Get an Orange County business tax receipt. Orange County Zoning Division will not accept Business Tax Receipt Applications in-person until further notice.

Business fees such as solid waste charges and water utility fees appear separately on the Orange County website. Business Tax Receipt Applications must be submitted electronically. Download and complete an electronic Business Tax Receipt Application.

If you would like to search for business tax receipts in Orange County please use the following search options. Taxes for a new business can be paid at any time during the year and are pro-rated beginning April 1 at which time a half-year fee applies. Apply for a New Business Tax Receipt Apply for a new Volusia County local business tax receipt online.

1600 O rlando FL 32801. Due to COVID-19 Orange County Zoning Division will not accept Business Tax Receipt Applications in person until further notice. All businesses home businesses and independent contractors that are located within the Orange City limits are required to pay a local business tax Business Tax Receipt.

Box 545100 Orlando FL 32851-5100. Taxes for new businesses can be paid at any time during the year and are prorated beginning April 1 at which time a half-year fee applies. Randolph represented Orange County residents in the Florida Legislature where he served as a senior member on the Finance and Tax Committee.