Newport News Business License

757-247-2500 Freedom of Information Act.

Newport news business license. 757-926-8657 ppnnvagov Related Taxes. The business license form is known as the Business Classification Information form BCI. The City of Newport Beach City Municipal Code provides that every business operating in the City is required to file a Business License Tax application prior to the start of business and pay the annual tax each year thereafter.

757-926-8651 buslnnvagov Personal Property. Newport News VA 23607 Main Office. Requiring evidence of payment of business license business personal property meals and admissions taxes.

Business License Information The City of Newport requires a business any for-profit or not-for-profit enterprise establishment store shop activity profession or undertaking of any nature operating within the city for more than 20 hours in one calendar year to obtain a city business license. 757-926-8657 ppnnvagov Related Taxes. A Business License Tax Account Office of Commissioner of the Revenue.

757-926-3535 taxreliefnnvagov State Income. 757-926-3535 taxreliefnnvagov State Income. Business License Application Businesses must file an application and pay applicable license taxes and fees prior to their first day of business.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Newport News Virginia Business License. How do I apply for a license in Newport News Virginia. Newport News VA 23607 Phone.

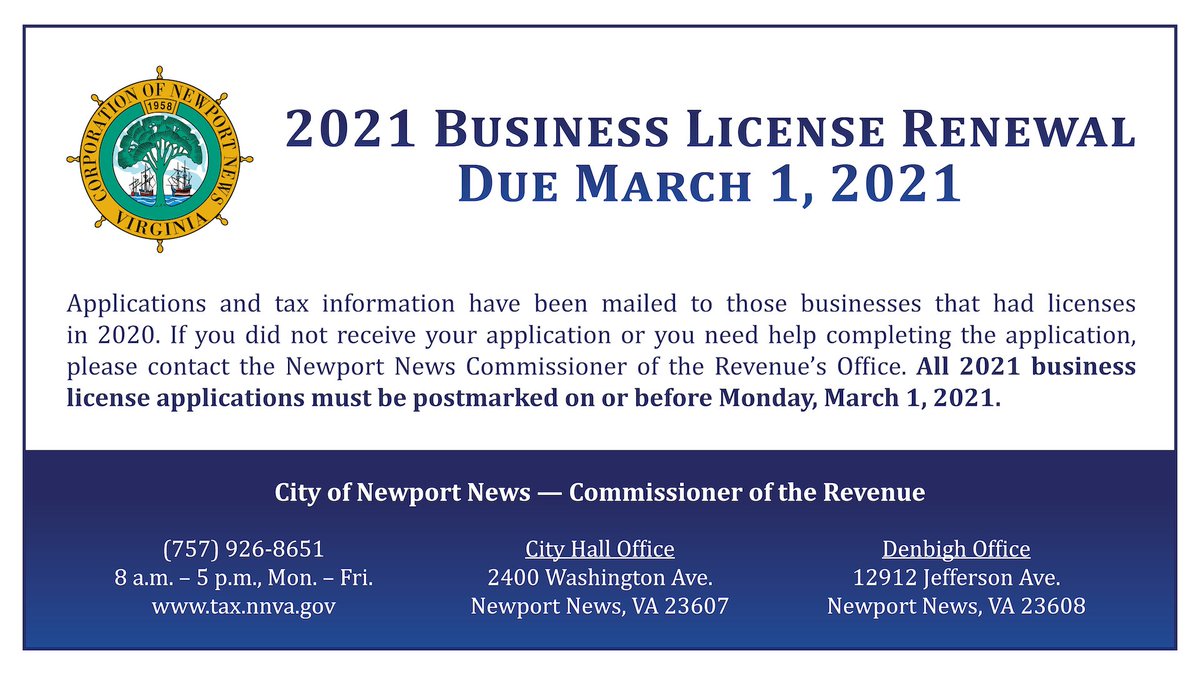

Newport News city County VA. The Commissioner of the Revenues office is responsible for classifying and issuing business licenses for businesses operating in Newport News. All licenses expire December 31st of each year and must be renewed by March 1st of the following year.