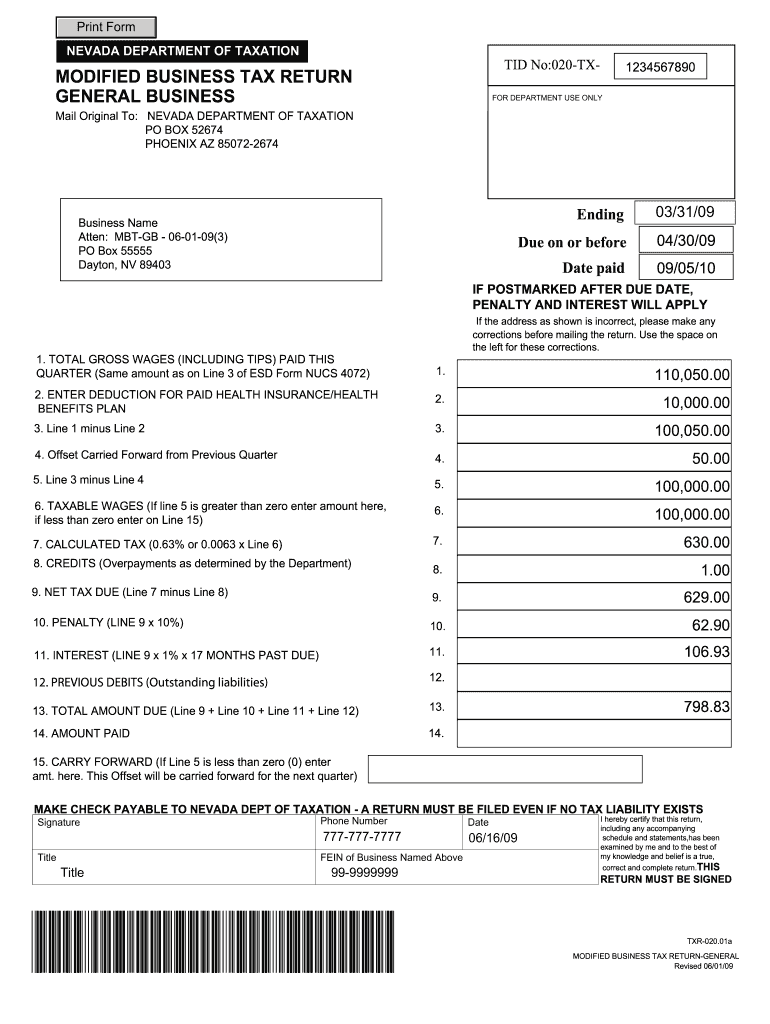

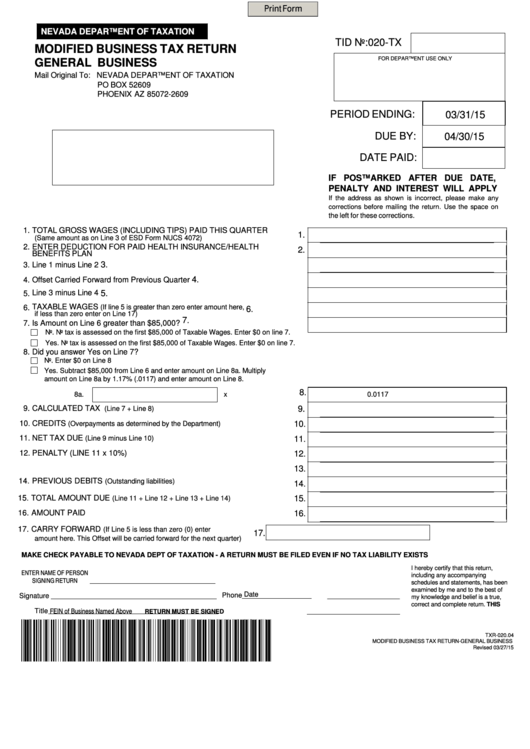

Nevada Modified Business Tax Form

Additionally the new threshold is decreased from 85000 to 50000 per quarter.

Nevada modified business tax form. Log In or Sign Up to get started with managing your business and filings online. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165. Take advantage of the fast search and advanced cloud editor to generate an accurate Nevada Modified Business Tax Form 2020.

Start a free trial now to save yourself time and money. Modified Business Tax is a self-reporting tax and you are responsible for properly characterizing your business as a Financial Institution or General Business. If you need help with the Nevada Modified Business Tax Form or the Nevada Modified Business Return AMS Payroll 134 is the best product to try.

Fill out securely sign print or email your nevada modified business tax 2016-2020 form instantly with SignNow. For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation. Welcome to the Nevada Tax Center The easiest way to manage your business tax filings with the Nevada Department of Taxation.

Form Name Modified Business Tax Return Filing Frequency Quarterly Filing Due Dates Due the last day of the month following the end of the quarter. The documents found below are available in at least one of three different formats Microsoft Word Excel or Adobe Acrobat PDF. Vehicle RV aircraft or vessel tax evasion.

Start a free trial now to save yourself time and money. Available for PC iOS and Android. W2s sent with Annual Filing.

Print form nevada department of taxation modified business tax return financial institutions mail original to. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business. Alterations of cash receipt journals.