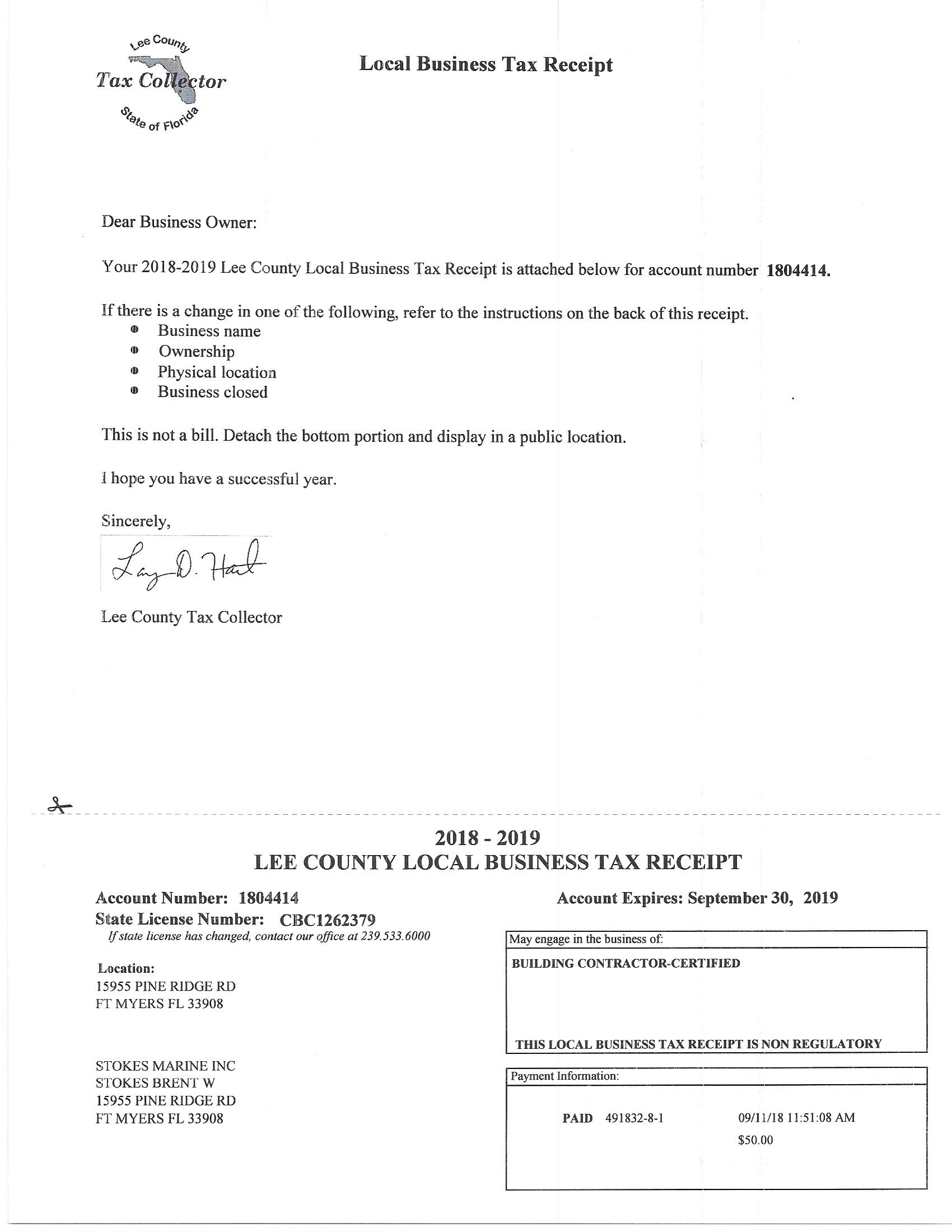

Lee County Business Tax Receipt

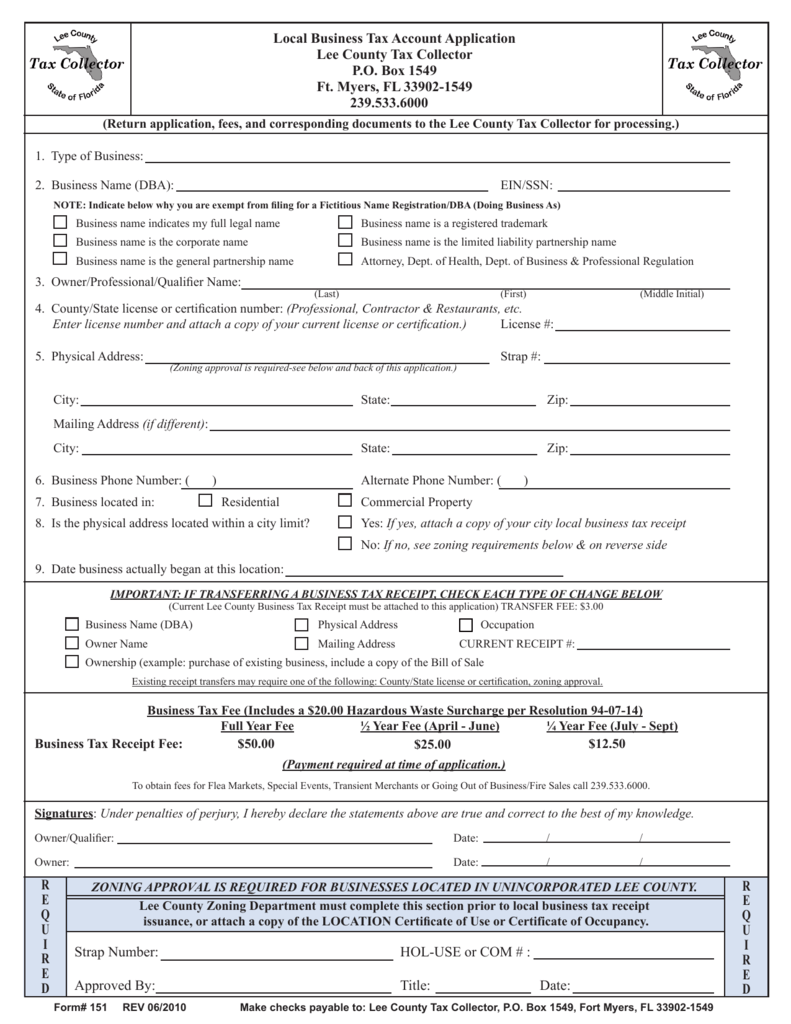

Prior to the issuance of the Lee County Local Business Tax Receipt the business location must be properly zoned.

Lee county business tax receipt. Contact the appropriate agency. Local license which is subject to an application and issuance through Lee County. Find out how you can make online payments for Lee County taxes utilities the Yacht Basin recreation programs and more.

Suite 101 Fort Myers FL 33901. Lee County Ordinance 00-26 Lee County Tax Collector T o perform work in unincorporated Lee County contractors must have a state-issued license OR a Certificate of Competency aka. The Planning Division is responsible for issuing business tax receipts to all new businesses within the city limits.

The County issues local business tax receipts for one year beginning Oct. LOCAL BUSINESS TAX APPLICATION For your convenience you can download the application. Business must have 250 or fewer full -time W 2 employees companies with common ownership andor common DBA will be treated as a single business.

Lee County Business Tax Receipt Lee County also requires that businesses obtain a county Business Tax Receipt after obtaining the city tax receipt. Lee County Tax Collector Business Tax Receipts Any person who wishes to start a business or has an established business from another county must obtain their Lee County Local Business Tax Account prior to doing business within Lee County with the exception of specific exemptions. Lee County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lee County Florida.

You do however need to obtain a Local Business Tax Receipt from the Lee County Tax Collector. For the next two payment options your tax receipt must not be expired and your business must be in a fixed fee rate category. The purpose of this Ordinance is to grant the privilege of engaging in or managing a business profession or occupation within the jurisdiction of Lee County by means of a Local Business Tax.

Fort Myers FL 33901. Tax receipts must be applied for in person at the Community Development Center at 1825 Hendry St. Nyone providing merchandise or services to the public within the jurisdiction of Lee County must obtain a Lee County business tax account to operate unless specifically exempted.